puerto rico tax incentives act 20

Act 20 provides Puerto Rico. Web To qualify the business cannot have any previous connections dealings or nexus with Puerto Rico.

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT.

. 4 Corporate Tax Rate. Taxes levied on their employment. This is substantial when you consider that if you.

100 Tax Exemption on Dividends or Profit Distributions. Fixed Income Tax Rate. Web Puerto Rico Corporations who qualify for the Act 20 tax exemptions can cut their corporate tax rate to a mere 4.

As well as aerospace biosciences technology renewable energy entrepreneurship and export services. Fixed Income tax rate of 4. 100 Tax Exemption on Property Taxes.

Services Hub Trading Act 20 Business Owners Investors Act 22 Film Games Production Act 27. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the. Web Puerto Rico Incentives Code 60 for prior Acts 2020.

100 income tax exemption for. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax. Web The tax exemptions offered by Act 20 are as follows.

Web this is the time to invest in puerto rico. Web On January 17 2012 Puerto Rico enacted Act No. Web Act 20 Puerto Rico Tax Incentives 4 Fixed Income Tax Rate on Income related to export of services or goods 100 Exemption on US Federal Income Tax 100 Tax Exemption on.

Make Puerto Rico Your New Home. Web PR Tax Incentive Puerto Rico has created an aggressive tax incentive program to connect with the global economy in order to establish an ever-growing array of service industries and to establish as an international service and trading hub center. Web Export Services incentive previously covered under Act 20 of 2012 known as the Act to Promote Export of Services was enacted in order to promote the exportation of services and lure foreign service businesses to relocate to Puerto Rico for the purposes of stimulating economic growth.

Web Act 20 for Export Service. Web It provides certainty related to the types of incentives that Puerto Rico offers to attract investment and create jobs in very important and traditional sectors such as manufacturing tourism and agriculture. Act 20 allows qualifying businesses that export services from the island nation the.

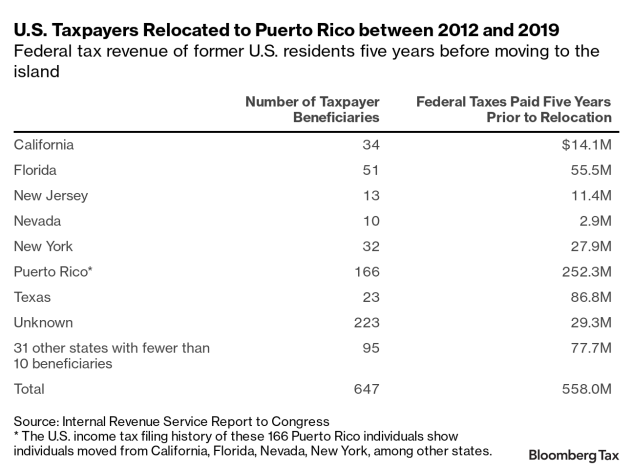

Many high-net worth Taxpayers are understandably upset about the massive US.

Puerto Rican Tax Incentives With International Tax Professional Peter Palsen Youtube

Why Entrepreneurs Should Move To Puerto Rico Inc Com

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Puerto Rico Tax Incentives Act 20 2012 U S Tax Havens

Loop Finance Puerto Rico Act 60 Tax Incentives Changing Very Soon Crypto And Stock Investors Need To Apply Asap

Act 20 22 To Build The Future Friends Of Puerto Rico

How Puerto Rico Became A Tax Haven For The Super Rich Gq

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Puerto Rico Tax Incentives Act 20 Act 22

Bdo In Puerto Rico A New Puerto Rico Tax Incentives Code Act 60 Was Signed Into Law On July 1 2019 And Substitutes Acts 20 And 22 Effective For Applications Filed

Puerto Rico Tax Incentives Can Puerto Rico Have Nice Things

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Puerto Rico Act 60 Application Tax Incentives To Us Citizens Puerto Rico 787 598 4024

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors